The Bitcoin of Governance: Logos and the End of Westphalia

Bitcoin fixes money; Logos rewires governance

Sev Bonnet

Community

For thousands of years, mankind has wrestled with the question of money: what makes it trustworthy, durable, and fair? From shells and beads to salt or Rai stones, civilisations experimented with many media of exchange. Some of them worked, until supply shocks (like silver experienced in the 16th–17th centuries) or ease of counterfeiting (metal coins) shattered trust in them.

For millennia, gold arguably embodied sound money: scarce, durable, fungible. But as a physical asset, it carries limits: it is heavy to move, difficult to divide, and dependent on trusted (or not) custodians. And even gold was not immune to political tampering: rulers repeatedly debased coinage by minting coins with less gold content, quietly expanding supply while pretending nothing had changed.

Fiat currencies solved portability but did so at the cost of scarcity: since Nixon ended the Bretton Woods system in 1971, largely to finance the Vietnam War, money can be printed at will (similar to the bank in the board game Monopoly, which “never goes bankrupt”). Rising government debt drives relentless money printing, burdening future generations with unfair obligations they never chose.

Bitcoin represents the first genuine reimagining of sound money for the digital era. Its fixed supply of 21 million units enforces scarcity, not by decree, but by mathematics. Its divisibility, down to one hundred million satoshis per bitcoin, makes it usable in many economic contexts, from small purchases to global trade (although micropayments are typically impractical onchain and generally require Layer-2 solutions such as the Lightning Network).

Secured by cryptography and a decentralised network of currently tens of thousands of nodes, Bitcoin is both perfectly portable across borders and resistant to seizure or censorship. Bitcoin has no CEO, no government seal of approval, no off switch; it just runs, kept alive by the people for the people. Its foundation is proof of work, which values effort alone rather than authority, rank, or wealth. Everyone can participate without gates (and also exit at any time), requiring nothing more than a smartphone, internet access, and a Bitcoin wallet.

Unlike every human invention that eventually is surpassed, or every living thing that eventually dies, Bitcoin is designed to endure indefinitely. It self-adjusts to changing conditions. Whether flooded with computational power or operating with modest resources, Bitcoin maintains a steady pace, producing a block roughly every ten minutes. Its issuance remains predictable through four-year halvings, and it settles transactions without any central point of failure.

Bitcoin proved that a decentralised network can power digital money without a central issuer. However, as powerful as it is, Bitcoin is far from perfect. It lacks programmability, privacy, and it was never designed to be a broader governance layer beyond the digital cash use case. Consequently, Ethereum extended the idea by making its chain programmable via smart contracts, so that rules and coordination logic could execute onchain beyond solely value transfers.

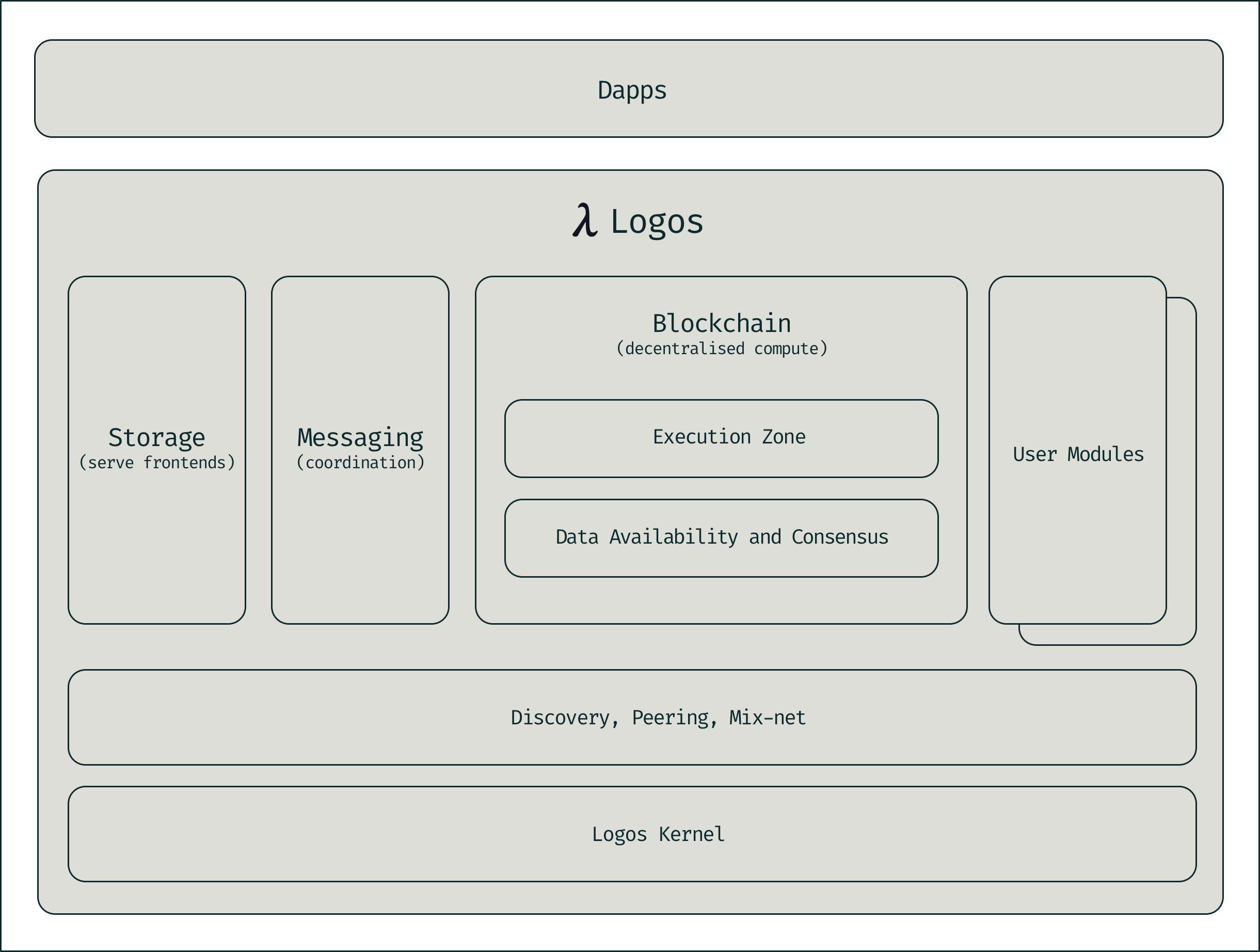

However, for onchain apps to claim sufficient sovereignty – i.e., the capability to endure efforts to disrupt or take them offline from the most powerful actors – that they would evolve into societal institutions, smart contracts are not enough. Ethereum’s original vision included elements beyond the blockchain to support truly decentralised applications: storage and messaging components. Logos is now creating the complete stack that Ethereum once envisioned, but never fully realised.

This stack forms the infrastructure for resilient, decentralised human cooperation. Its blockchain component, in particular, addresses areas beyond Bitcoin’s original scope, pairing programmability with strong privacy guarantees at the network level (both lacking in Bitcoin and Ethereum). Bitcoin makes money hard to corrupt. The Logos stack will do the same for governance: enabling like-minded communities (like Logos Circles initially) to cooperate securely and privately.

Here, Logos converges with its philosophical cypherpunk foundation: “Privacy is not secrecy, it is a fundamental right.” Privacy here is not about hiding from accountability but about defending human dignity and autonomy against arbitrary interference. In this sense, Logos is a digital Switzerland of the electronic age.

Logos, like Bitcoin, embraces openness and sovereignty. Culture, as Logos puts it, “is free, forkable, and open”. Just as anyone can build on top of Bitcoin’s open-source code, anyone can contribute to or build upon the Logos stack. Anyone will be able to run a node, hold an equal copy of the ledger, or participate in the network’s governance. Logos is a sovereign blockchain community: borderless, voluntary, censorship-resistant, and permissionless.

This is governance redefined: not by decree, but by protocol. Bitcoin pioneered it in money; Logos carries it further into the digital commons. “Human governance, if it is working well, not only enables the generation and preservation of wealth but also enables the flourishing of human cultures and assists individuals in securing their personal freedom,” write Jarrad Hope and Peter Ludlow in Farewell to Westphalia. Bitcoin enacts this vision in the realm of money; Logos extends it to governance, privacy, and culture.

We are entering an era where political borders are becoming porous and centralised institutions are losing legitimacy. In this landscape, Logos provides more than just a foundation for decentralised governance; it is the architecture for sovereignty at the level of individuals and communities. Logos offers a system for a world in transition, one that no longer depends on trust in failing institutions but on transparent, tamper-resistant blockchain protocols. It is a new framework for human cooperation and freedom in the digital age.

Its promise, together with the ecosystem it fosters, is a new form of governance and digital infrastructure that has the potential to outlast the very states that claimed a monopoly over both.

I'd like to end with the words of Timothy May’s Crypto Anarchist Manifesto:

Logos represents the chance to leave those fences behind, with nothing to lose and freedom to gain.

Logos is an open-source movement aiming to revitalise civil society. We need coders, writers, designers, and all forward thinkers to join us. To get involved, head to the Logos Contribute portal and submit a proposal.

Discussion

JosiahWarren

Community

JosiahWarren

Community

Bitzu

Sev Bonnet

JosiahWarren

Community